In this article, we will continue building a backtesting engine from scratch. We will add many features and make many changes, so make sure to read Part 1 of this series before reading this article!

As a quick recap, in Part 1 of this series, we’ve laid out the basics of any backtesting framework:

- Designed the structure of our framework: implemented Engine, Order, Trade, and Strategy classes

- Basic methods: run(), add_data(), buy(), sell(), add_strategy(), on_bar()

- Basic output: once the backtest is complete, the engine will calculate the strategy’s total return.

- Sanity check: we’ve compared our results with Backtesting.py

Although we can already do a whole lot of backtesting with what we’ve implemented, we surely would like to expand the framework’s capabilities! In this article, I’ll cover the following topics:

- Limit orders: implementing orders with limited prices requires refactoring some classes and methods

- Add a Benchmark: We will add a Buy & Hold strategy for the same asset for comparison purposes.

- Output Statistics: annualized returns, volatility, Sharpe Ratio, and Maximum Drawdown for both the strategy and the benchmark. Exposure of our strategy to the asset as a percentage of total assets under management.

- Plotting features: every backtesting engine out there has plotting capabilities, and our framework will not be the exception!

For organizational purposes, I’ll break down this tutorial into different sections. I’ll start by adding the limit orders.

Table of Contents

Implementing Limit Orders

This feature impacts quite a few parts of our backtesting engine. Let’s try not to break everything!

1) Add buy_limit and sell_limit methods to our Strategy class

These methods are similar to the market buy and sell methods we created in Part 1 but with a few obvious extra parameters.

def buy_limit(self,ticker,limit_price, size=1):

self.orders.append(

Order(

ticker = ticker,

side = 'buy',

size = size,

limit_price=limit_price,

order_type='limit',

idx = self.current_idx

))def sell_limit(self,ticker,limit_price, size=1):

self.orders.append(

Order(

ticker = ticker,

side = 'sell',

size = -size,

limit_price=limit_price,

order_type='limit',

idx = self.current_idx

))2) Add limit_price and order_type attributes to the Order Class

class Order():

def __init__(self, ticker, size, side, idx, limit_price=None, order_type='market'):

...

self.type = order_type

self.limit_price = limit_price3) Update the _fill_orders() method

This section is definitely the most complex of the implementation, so make sure to read it line by line. I added a few comments to guide you through the logic.

We’ll throw in a few print statements to simplify debugging. Once we’re done testing the logic, we can remove them.

def _fill_orders(self):

for order in self.strategy.orders:

# FOR NOW, SET FILL PRICE TO EQUAL OPEN PRICE. THIS HOLDS TRUE FOR MARKET ORDERS

fill_price = self.data.loc[self.current_idx]['Open']

can_fill = False

if order.side == 'buy' and self.cash >= self.data.loc[self.current_idx]['Open'] * order.size:

if order.type == 'limit':

# LIMIT BUY ORDERS ONLY GET FILLED IF THE LIMIT PRICE IS GREATER THAN OR EQUAL TO THE LOW PRICE

if order.limit_price >= self.data.loc[self.current_idx]['Low']:

fill_price = order.limit_price

can_fill = True

print(self.current_idx, 'Buy Filled. ', "limit",order.limit_price," / low", self.data.loc[self.current_idx]['Low'])

else:

print(self.current_idx,'Buy NOT filled. ', "limit",order.limit_price," / low", self.data.loc[self.current_idx]['Low'])

else:

can_fill = True

elif order.side == 'sell' and self.strategy.position_size >= order.size:

if order.type == 'limit':

#LIMIT SELL ORDERS ONLY GET FILLED IF THE LIMIT PRICE IS LESS THAN OR EQUAL TO THE HIGH PRICE

if order.limit_price <= self.data.loc[self.current_idx]['High']:

fill_price = order.limit_price

can_fill = True

print(self.current_idx,'Sell filled. ', "limit",order.limit_price," / high", self.data.loc[self.current_idx]['High'])

else:

print(self.current_idx,'Sell NOT filled. ', "limit",order.limit_price," / high", self.data.loc[self.current_idx]['High'])

else:

can_fill = True

if can_fill:

t = Trade(

ticker = order.ticker,

side = order.side,

price= fill_price,

size = order.size,

type = order.type,

idx = self.current_idx)

self.strategy.trades.append(t)

self.cash -= t.price * t.size

self.strategy.orders = []By clearing the list of pending orders at the end of the method, we are assuming that limit orders are only valid for the day. This behavior tends to be the default. Implementing good till-granted (GTC) orders would require us to keep all unfilled limit orders.

4) Add a close property in the Strategy class to retrieve the latest close

This property will allow us to access the current close with a simple self.close line in the Strategy class. Although not strictly required, it is very convenient for setting the limit prices of our orders (ie, limit_price = self.close * 0.995)

Add this property to the Strategy base class

@property

def close(self):

return self.data.loc[self.current_idx]['Close']5) Testing the feature

Let’s use the BuyAndSellSwitch strategy we created in the previous article to review the limit orders.

In this simple scenario, we will try to buy and sell at a slightly more convenient price. In other words, our buy orders will have a limit price below the latest close, whereas our sell orders will have a limit price above it.

import yfinance as yf

class BuyAndSellSwitch(Strategy):

def on_bar(self):

if self.position_size == 0:

limit_price = self.close * 0.995

self.buy_limit('AAPL', size=100,limit_price=limit_price)

print(self.current_idx,"buy")

else:

limit_price = self.close * 1.005

self.sell_limit('AAPL', size=100,limit_price=limit_price)

print(self.current_idx,"sell")

data = yf.Ticker('AAPL').history(start='2022-12-01', end='2022-12-31', interval='1d')

e = Engine()

e.add_data(data)

e.add_strategy(BuyAndSellSwitch())

e.run()

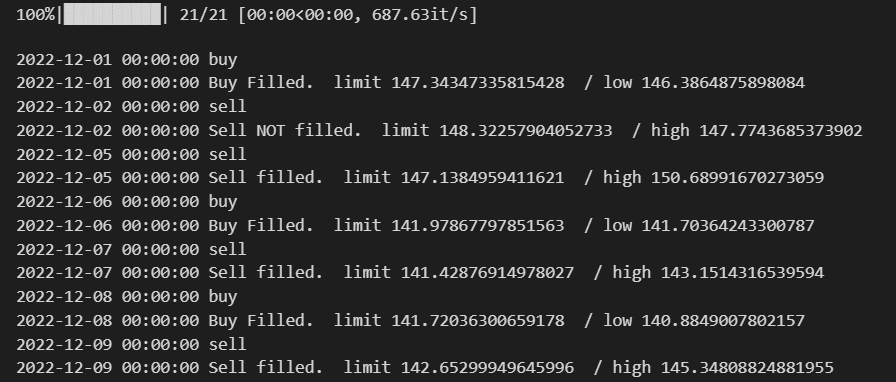

At first sight, the code seems to be working properly. Our first sell order did not get filled because we had a limit price greater than the high. A sell order did get filled on the next bar because our limit price was lower than the day’s high. This behavior is correct!

Adding Output Metrics

We’ll want to keep track of our cash and stock holdings in each period. This will allow us to calculate the exposure of our portfolio to the market. It is also a prerequisite for calculating annualized volatility. We’ll also want to keep track of our position size.

In the __init__() method of the Engine class, create an empty dictionary for holding the cash series and another for the stock series. The sum of both values in each period equals the total assets under management.

class Engine():

def __init__(self, initial_cash=100_000):

...

self.cash_series = {}

self.stock_series = {}After each iteration in the run() method of the Engine class, add the cash holdings to the cash_series:

def run(self):

...

for idx in tqdm(self.data.index):

...

self.cash_series[idx] = self.cash

self.stock_series[idx] = self.strategy.position_size * self.data.loc[self.current_idx]['Close']Now it’s time to add a few extra metrics to our engine! We’ll add those in the _get_stats method() that gets invoked at the end of the run() method.

def _get_stats(self):

metrics = {}

...

return metricsWe’ll be using the numpy library, so make sure to install it! (pip install numpy).

I’ll break down the additions to the _get_stats() method into smaller bits.

Buy & Hold Benchmark

The benchmark consists of buying as many shares as our cash allows us to in the first bar and holding them throughout the entire backtesting period.

portfolio_bh = self.initial_cash / self.data.loc[self.data.index[0]]['Open'] * self.data.CloseExposure to the Asset [%]

We will define the exposure to the asset as a ratio of stock holdings over total assets under management at each period. Thus the average exposure of the strategy will be the average exposure of all bars.

We’ll start by creating a DataFrame containing the cash and stock holdings series and another column with the total assets under management. Finally, we have to calculate the average of the ratio.

# Create a dataframe with the cash and stock holdings at the end of each bar

portfolio = pd.DataFrame({'stock':self.stock_series, 'cash':self.cash_series})

# Add a third column with the total assets under managemet

portfolio['total_aum'] = portfolio['stock'] + portfolio['cash']

# Caclulate the total exposure to the asset as a percentage of our total holdings

metrics['exposure_pct'] = ((portfolio['stock'] / portfolio['total_aum']) * 100).mean()Annualized Returns

# Calculate annualized returns

p = portfolio.total_aum

metrics['returns_annualized'] = ((p.iloc[-1] / p.iloc[0]) ** (1 / ((p.index[-1] - p.index[0]).days / 365)) - 1) * 100

p_bh = portfolio_bh

metrics['returns_bh_annualized'] = ((p_bh.iloc[-1] / p_bh.iloc[0]) ** (1 / ((p_bh.index[-1] - p_bh.index[0]).days / 365)) - 1) * 100

Annualized Volatility

For this calculation,

I’m assuming we’re using daily data of an asset that trades only during working days (i.e., stocks). If you’re trading cryptocurrencies, use 365 instead of 252.

self.trading_days = 252

metrics['volatility_ann'] = p.pct_change().std() * np.sqrt(self.trading_days) * 100

metrics['volatility_bh_ann'] = p_bh.pct_change().std() * np.sqrt(self.trading_days) * 100I added a trading_days attribute to the Engine Class. Consider adding it as a parameter during the initialization of the object instead of here.

Sharpe Ratio

Now that we have the annualized returns and volatility, we can calculate the Sharpe Ratio. Keep in mind that the Sharpe Ratio also uses the risk-free rate. For simplicity, I’m assuming a risk-free rate of 0. You should define the risk_free_rate in the __init__() method instead of here.

self.risk_free_rate = 0

metrics['sharpe_ratio'] = (metrics['returns_annualized'] - self.risk_free_rate) / metrics['volatility_ann']

metrics['sharpe_ratio_bh'] = (metrics['returns_bh_annualized'] - self.risk_free_rate) / metrics['volatility_bh_ann']Maximum Drawdown

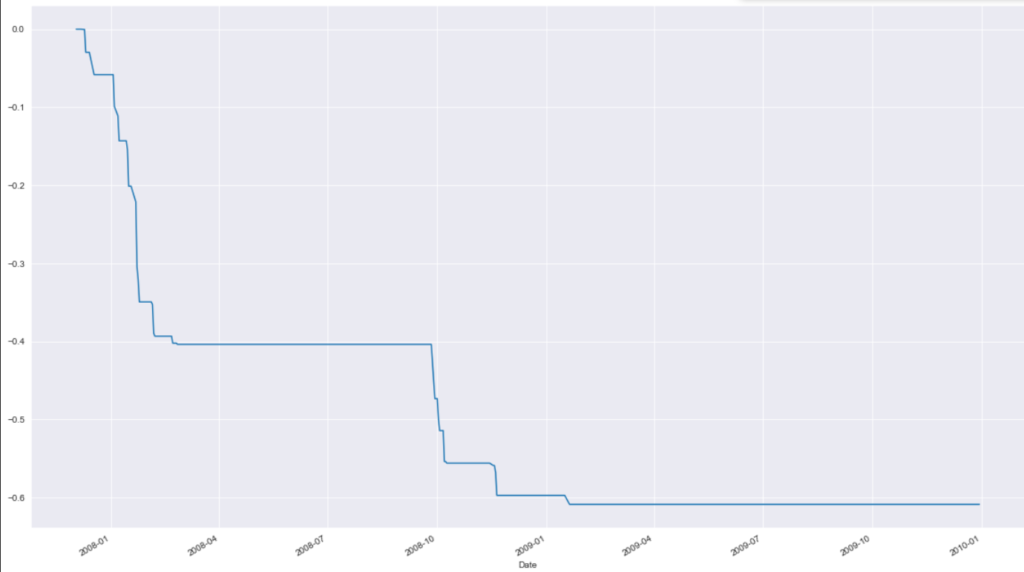

This metric is tough to implement, so I’ll break it down into smaller bits and add plots to make it easier to understand what’s happening under the hood.

I have also not found a good online resource covering the step-by-step process. What are new articles for if not for adding new information to the internet?

We’ll be plotting quite a lot, so let’s start by importing a few libraries:

# Import matplotlib

import matplotlib.pyplot as plt

# Setting a nice style for the plots

import seaborn as sns

sns.set_style('darkgrid')

# Make plots bigger

plt.rcParams['figure.figsize'] = [20,12]I will be using the daily prices of AAPL stock during the 2008 crisis.

data = yf.Ticker('AAPL').history(start='2007-12-01', end='2009-12-31', interval='1d')

close = data.Close

close.plot()

Let’s keep track of the cumulative maximum of the rolling series. Don’t worry; it will make sense later on!

roll_max = close.cummax()

roll_max.plot()

We can now calculate each day’s drawdown relative to the past maximum value.

daily_drawdown = close / roll_max - 1.0

daily_drawdown.plot()

We’re almost done! Let’s keep track of the rolling minimum drawdown:

max_daily_drawdown = daily_drawdown.cummin()

max_daily_drawdown.plot()

If we take the minimum value of the series, we’ll arrive at the maximum drawdown! Let’s put it all together in a single function that we can use:

def get_max_drawdown(close):

roll_max = close.cummax()

daily_drawdown = close / roll_max - 1.0

max_daily_drawdown = daily_drawdown.cummin()

return max_daily_drawdown.min() * 100Extra data for later use

For plotting purposes, we’ll store the portfolio series.

self.portfolio = portfolio

self.portfolio_bh = portfolio_bhSanity Checks

Let’s implement a simple backtest to check if our metrics are reasonable! I’ll replicate a Buy & Hold strategy and compare it to the benchmark results.

import yfinance as yf

class Test1(Strategy):

def on_bar(self):

if self.position_size == 0:

limit_price = self.close * 0.995

# We'll try to buy spend all our available cash!

self.buy_limit('AAPL', size=8.319, limit_price=limit_price)

print(self.current_idx,"buy")

data = yf.Ticker('AAPL').history(start='2020-12-01', end='2022-12-31', interval='1d')

e = Engine(initial_cash=1000)

e.add_data(data)

e.add_strategy(Test1())

e.run()

As we can see, the results don’t quite match. This is because I rounded the initial buy limit order to the third decimal. Moreover, we created the order with a limit_price, which got executed on the next open, whereas the benchmark buys in the first period with a market order at the open price.

Implementing an SMA Crossover Strategy

At last, let’s backtest something interesting! For this strategy, we will use the following indicators:

- 12-day simple moving average

- 24-day simple moving average

Whenever the 12-day moving average crosses above the 24-day moving average, we will buy. Conversely, whenever the 12-day moving average crosses below the 24-day moving average, we will sell.

It would be nice to buy as many stocks as our cash allows at any given time instead of always trading a fixed number of stocks. To do so, we would need access to the cash attribute in the Strategy class, but we are currently storing that attribute in the Engine class.

To add this feature, do the following:

- Add the following line in the Strategy’s __init__() method: self.cash = None

- At the start of the run() method, add the following line: self.strategy.cash = self.cash

- At the end of the _fill_orders() method, add the following line: self.cash = self.strategy.cash. Make sure to add it after updating the cash variable of the engine object.

Once we’ve added this feature, we can implement the strategy!

import yfinance as yf

class SMACrossover(Strategy):

def on_bar(self):

if self.position_size == 0:

if self.data.loc[self.current_idx].sma_12 > self.data.loc[self.current_idx].sma_24:

limit_price = self.close * 0.995

# BUY AS MANY SHARES AS WE CAN!

order_size = self.cash / limit_price

self.buy_limit('AAPL', size=order_size, limit_price=limit_price)

elif self.data.loc[self.current_idx].sma_12 < self.data.loc[self.current_idx].sma_24:

limit_price = self.close * 1.005

self.sell_limit('AAPL', size=self.position_size, limit_price=limit_price)

data = yf.Ticker('AAPL').history(start='2010-12-01', end='2022-12-31', interval='1d')

e = Engine(initial_cash=1000)

data['sma_12'] = data.Close.rolling(12).mean()

data['sma_24'] = data.Close.rolling(24).mean()

e.add_data(data)

e.add_strategy(SMACrossover())

stats = e.run()

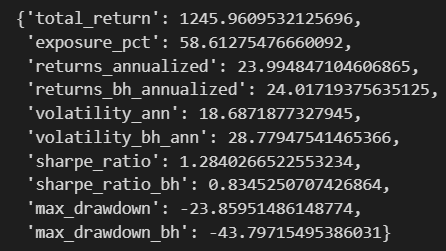

print(stats)

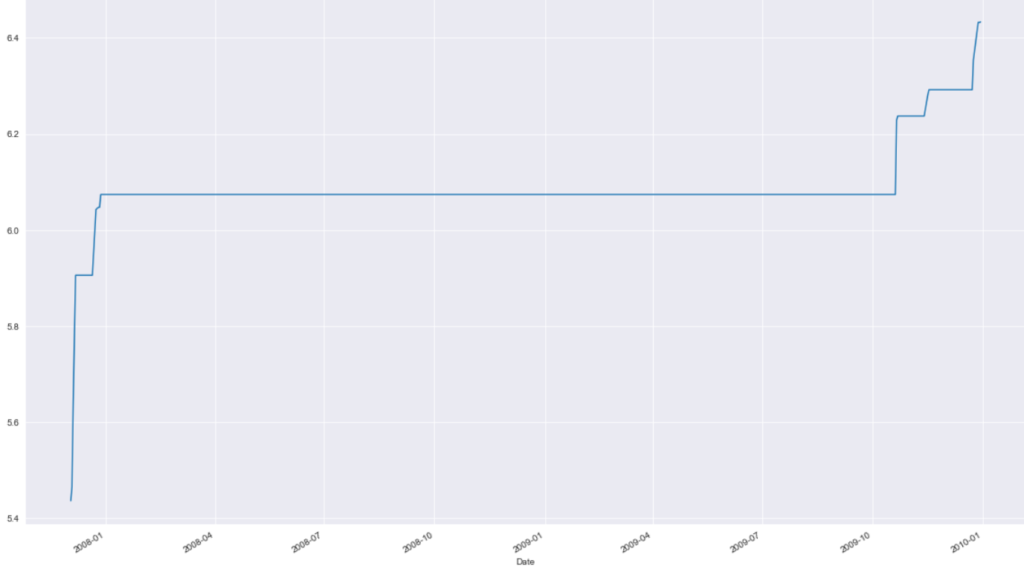

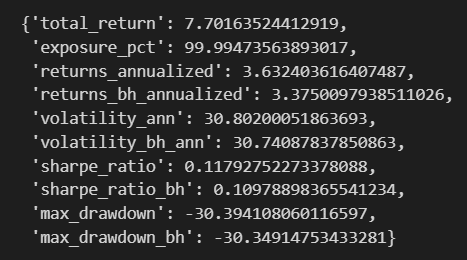

As can be seen, this simple strategy had outstanding results during the backtesting period, and for a good reason: I tweaked the parameters until they yielded good results. This practice is known as overfitting and is a very bad one! Thus, the resulting strategy is equally terrible and only meant to show how to use our newly coded backtesting engine.

Our backtest had almost identical returns compared to the buy and held benchmark but a much higher Sharpe Ratio. The lower exposure percentage explains this, which results in a much lower annualized volatility.

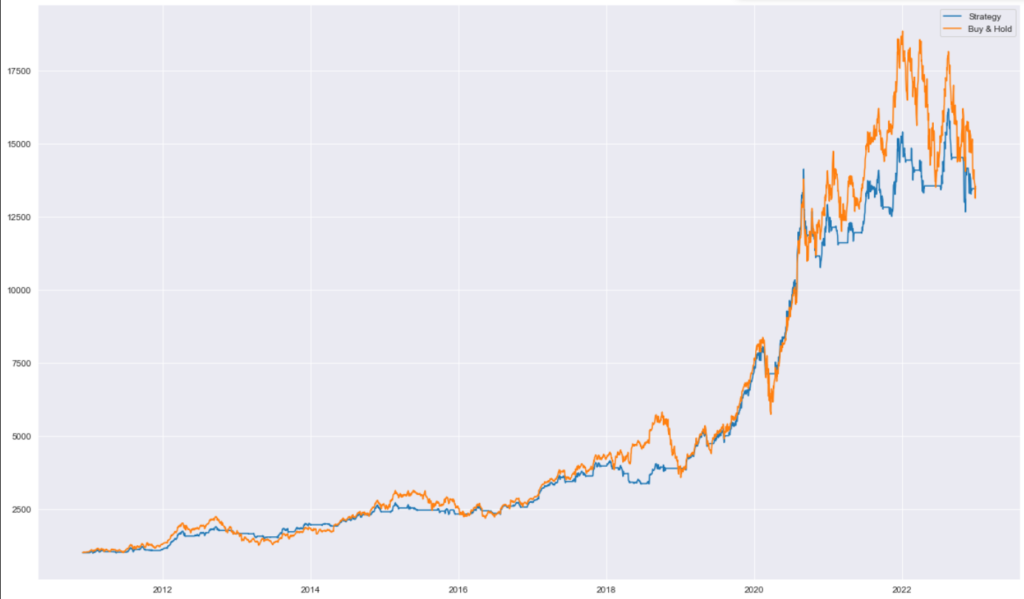

Add Plotting Features

Let’s end this article on a high note! What’s nicer than looking at a price chart that goes up and to the right? Let’s create the feature that will allow us to visualize that chart!

It is extremely simple, but it serves as a good starting point. Make sure to add it as a method of the Engine class.

def plot(self):

plt.plot(self.portfolio['total_aum'],label='Strategy')

plt.plot(self.portfolio_bh,label='Buy & Hold')

plt.legend()

plt.show()We can now plot the results by calling the method after running the backtest!

e.plot()

Putting Everything Together

If we put everything together, our backtesting framework should look as follows:

import seaborn as sns

import matplotlib.pyplot as plt

plt.rcParams['figure.figsize'] = [20, 12]

import pandas as pd

from tqdm import tqdm

import numpy as np

class Order():

def __init__(self, ticker, size, side, idx, limit_price=None, order_type='market'):

self.ticker = ticker

self.side = side

self.size = size

self.type = order_type

self.limit_price = limit_price

self.idx = idx

class Trade():

def __init__(self, ticker,side,size,price,type,idx):

self.ticker = ticker

self.side = side

self.price = price

self.size = size

self.type = type

self.idx = idx

def __repr__(self):

return f'<Trade: {self.idx} {self.ticker} {self.size}@{self.price}>'

class Strategy():

def __init__(self):

self.current_idx = None

self.data = None

self.cash = None

self.orders = []

self.trades = []

def buy(self,ticker,size=1):

self.orders.append(

Order(

ticker = ticker,

side = 'buy',

size = size,

idx = self.current_idx

))

def sell(self,ticker,size=1):

self.orders.append(

Order(

ticker = ticker,

side = 'sell',

size = -size,

idx = self.current_idx

))

def buy_limit(self,ticker,limit_price, size=1):

self.orders.append(

Order(

ticker = ticker,

side = 'buy',

size = size,

limit_price=limit_price,

order_type='limit',

idx = self.current_idx

))

def sell_limit(self,ticker,limit_price, size=1):

self.orders.append(

Order(

ticker = ticker,

side = 'sell',

size = -size,

limit_price=limit_price,

order_type='limit',

idx = self.current_idx

))

@property

def position_size(self):

return sum([t.size for t in self.trades])

@property

def close(self):

return self.data.loc[self.current_idx]['Close']

def on_bar(self):

"""This method will be overriden by our strategies.

"""

pass

class Engine():

def __init__(self, initial_cash=100_000):

self.strategy = None

self.cash = initial_cash

self.initial_cash = initial_cash

self.data = None

self.current_idx = None

self.cash_series = {}

self.stock_series = {}

def add_data(self, data:pd.DataFrame):

# Add OHLC data to the engine

self.data = data

def add_strategy(self, strategy):

# Add a strategy to the engine

self.strategy = strategy

def run(self):

# We need to preprocess a few things before running the backtest

self.strategy.data = self.data

self.strategy.cash = self.cash

for idx in tqdm(self.data.index):

self.current_idx = idx

self.strategy.current_idx = self.current_idx

# fill orders from previus period

self._fill_orders()

# Run the strategy on the current bar

self.strategy.on_bar()

self.cash_series[idx] = self.cash

self.stock_series[idx] = self.strategy.position_size * self.data.loc[self.current_idx]['Close']

return self._get_stats()

def _fill_orders(self):

for order in self.strategy.orders:

# FOR NOW, SET FILL PRICE TO EQUAL OPEN PRICE. THIS HOLDS TRUE FOR MARKET ORDERS

fill_price = self.data.loc[self.current_idx]['Open']

can_fill = False

if order.side == 'buy' and self.cash >= self.data.loc[self.current_idx]['Open'] * order.size:

if order.type == 'limit':

# LIMIT BUY ORDERS ONLY GET FILLED IF THE LIMIT PRICE IS GREATER THAN OR EQUAL TO THE LOW PRICE

if order.limit_price >= self.data.loc[self.current_idx]['Low']:

fill_price = order.limit_price

can_fill = True

print(self.current_idx, 'Buy Filled. ', "limit",order.limit_price," / low", self.data.loc[self.current_idx]['Low'])

else:

print(self.current_idx,'Buy NOT filled. ', "limit",order.limit_price," / low", self.data.loc[self.current_idx]['Low'])

else:

can_fill = True

elif order.side == 'sell' and self.strategy.position_size >= order.size:

if order.type == 'limit':

#LIMIT SELL ORDERS ONLY GET FILLED IF THE LIMIT PRICE IS LESS THAN OR EQUAL TO THE HIGH PRICE

if order.limit_price <= self.data.loc[self.current_idx]['High']:

fill_price = order.limit_price

can_fill = True

print(self.current_idx,'Sell filled. ', "limit",order.limit_price," / high", self.data.loc[self.current_idx]['High'])

else:

print(self.current_idx,'Sell NOT filled. ', "limit",order.limit_price," / high", self.data.loc[self.current_idx]['High'])

else:

can_fill = True

if can_fill:

t = Trade(

ticker = order.ticker,

side = order.side,

price= fill_price,

size = order.size,

type = order.type,

idx = self.current_idx)

self.strategy.trades.append(t)

self.cash -= t.price * t.size

self.strategy.cash = self.cash

# BY CLEARING THE LIST OF PENDING ORDERS, WE ARE ASSUMING THAT LIMIT ORDERS ARE ONLY VALID FOR THE DAY

# THIS TENDS TO BE THE DEFAULT. IMPLEMENTING GOOD TILL GRANTED WOULD REQUIRE US TO KEEP ALL UNFILLED LIMIT ORDERS.

self.strategy.orders = []

def _get_stats(self):

metrics = {}

total_return = 100 *((self.data.loc[self.current_idx]['Close'] * self.strategy.position_size + self.cash) / self.initial_cash -1)

metrics['total_return'] = total_return

# Create a the Buy&Hold Benchmark

portfolio_bh = (self.initial_cash / self.data.loc[self.data.index[0]]['Open']) * self.data.Close

# Create a dataframe with the cash and stock holdings at the end of each bar

portfolio = pd.DataFrame({'stock':self.stock_series, 'cash':self.cash_series})

# Add a third column with the total assets under managemet

portfolio['total_aum'] = portfolio['stock'] + portfolio['cash']

# Caclulate the total exposure to the asset as a percentage of our total holdings

metrics['exposure_pct'] = ((portfolio['stock'] / portfolio['total_aum']) * 100).mean()

# Calculate annualized returns

p = portfolio.total_aum

metrics['returns_annualized'] = ((p.iloc[-1] / p.iloc[0]) ** (1 / ((p.index[-1] - p.index[0]).days / 365)) - 1) * 100

p_bh = portfolio_bh

metrics['returns_bh_annualized'] = ((p_bh.iloc[-1] / p_bh.iloc[0]) ** (1 / ((p_bh.index[-1] - p_bh.index[0]).days / 365)) - 1) * 100

# Calculate the annualized volatility. I'm assuming that we're using daily data of an asset that trades only during working days (ie: stocks)

# If you're trading cryptos, use 365 instead of 252

self.trading_days = 252

metrics['volatility_ann'] = p.pct_change().std() * np.sqrt(self.trading_days) * 100

metrics['volatility_bh_ann'] = p_bh.pct_change().std() * np.sqrt(self.trading_days) * 100

# Now that we have the annualized returns and volatility, we can calculate the Sharpe Ratio

# Keep in mind that the sharpe ratio also requires the risk free rate. For simplicity, I'm assuming a risk free rate of 0.as_integer_ratio

# You should define the risk_free_rate in the __init__() method instead of here.

self.risk_free_rate = 0

metrics['sharpe_ratio'] = (metrics['returns_annualized'] - self.risk_free_rate) / metrics['volatility_ann']

metrics['sharpe_ratio_bh'] = (metrics['returns_bh_annualized'] - self.risk_free_rate) / metrics['volatility_bh_ann']

# For later plotting purposes, we'll store the portfolio series

self.portfolio = portfolio

self.portfolio_bh = portfolio_bh

# Max drawdown

metrics['max_drawdown'] = get_max_drawdown(portfolio.total_aum)

metrics['max_drawdown_bh'] = get_max_drawdown(portfolio_bh)

return metrics

def plot(self):

plt.plot(self.portfolio['total_aum'],label='Strategy')

plt.plot(self.portfolio_bh,label='Buy & Hold')

plt.show()

def get_max_drawdown(close):

roll_max = close.cummax()

daily_drawdown = close / roll_max - 1.0

max_daily_drawdown = daily_drawdown.cummin()

return max_daily_drawdown.min() * 100Further Implementations

Having reached the end of this article, I still would like to add many additional features. As with any interesting project, we can keep expanding, but I must keep these articles to a reasonable length. Thus, I’ll probably write a third part of this series with a few extra features. On the top of my head, these come to mind:

- Take profits and stop losses

- Fees and Slippage

- Create a P&L of the tradelog

- More output stats: average win/loss, Calmar and Sortino ratios, conditional value-at-risk, etc.

9 Responses

These two posts have been a massive inspiration for me to create a backtesting platform for my python project.

I can’t wait to see the third part.

I’m glad you liked it! This series of articles is my favorite content piece I’ve created thus far. I’m also thinking about expanding it further and turning it into a book!

Can’t thank enough for this two post series on python and its application for backtesting trading strategies . I have taken couple of python courses before, but I finally understand here how to use it for trading and without applying any fancy libraries. it’s utterly simple.

I’m glad you liked it! I really enjoyed writing it. I’m even thinking about expanding it into a book.

Honorable Mr Marty MK, thank you for the 2 series articles, very informative. I appreciate your time and effort.

I could follow your explanation more than ChatGPT, thanks a million!

I really appreciate it! I’m glad you found it useful!

Excellent post. I have a question though:

In run(), why is current_idx set to idx after fill_orders() and not before? Because currently, fill_orders is setting the order price to the Open of the period the signal was generated in. Shouldn’t it instead be the Open of the next period?

Ibrahim, you’re completely right! Thanks for spotting the error, I introduced it while copy-pasting from vscode into WordPress. I really appreciate it!